Can I afford a car loan with a monthly salary of $2700?

Can I afford a car loan with a monthly salary of $2700?

Hi Jannou I believe that I am prepared to buy my own vehicle and finally experience the freedom that comes with it, based on your most recent blog. I'm ready to put the hassle of using public transportation behind me at last. I do have one query, though. How do I figure out how much car I can afford based on my salary? I typically make $2700 per month after taxes. Can you assist?

Dear reader, thank you for reaching out, and congratulations on your desire to take the next step. "How much car can I afford?" is a question that many people ask, especially if it is their first time. To help answer this question, you must consider your monthly income and expenses, as well as the ongoing cost of car ownership. We recommend that you create a customized monthly budget to help with this. This budget will provide a detailed picture of your financial situation. To determine how much car you can afford you can use this step-by-step guide to assist you.

Step 1:

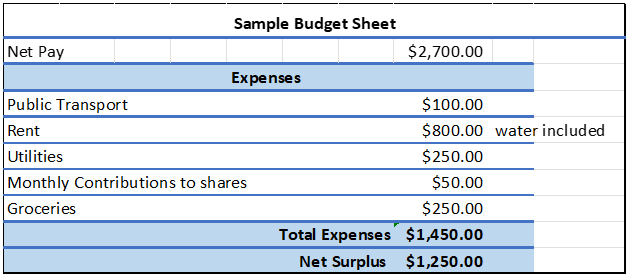

The first step is to calculate your monthly spending. Calculating your net income after monthly deductions is the next step since you already know what your net pay is after taxes. You will total up all your expenses in this step, such as bill payments, saving contributions, and groceries. Based on your own expenses, make any necessary changes. You can either use a budgeting app, Microsoft Excel, or the more traditional pen and paper method to help create the budget. Keep in mind to be completely honest with yourself and not omit any information. View the example of a simple budget sheet below.

Step 2:

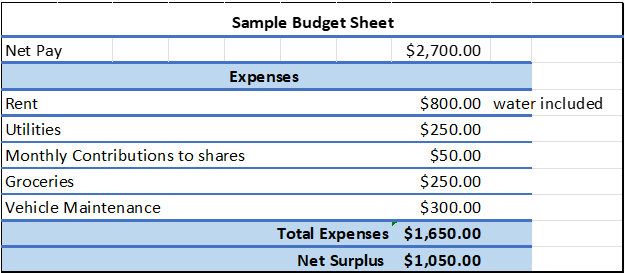

Now that you know how much money you spend on average per month, you must now consider how much money you will need to maintain the vehicle monthly. You would have already done your research on average monthly vehicle maintenance costs. That sum can now be entered into your budget sheet. Assume that your monthly upkeep costs are between $300 and $350 for a low-maintenance vehicle. After all these deductions, your net pay will determine how much you can realistically afford to pay toward your monthly loan payment.

Step 3:

Following the completion of the first two steps, you can use a loan calculator to calculate how much car you can afford based on your final budget sheet. Your salary has now been reduced by $1050, implying that your loan payment will range from $500 to $650, depending on whether the vehicle is new or used. This would equate to $45,000 for a new vehicle and $25,000 for a used vehicle.

Need advice related to vehicle loans and purchases don’t hesitate to send us a message.

Written by Sheralye Alcindor